What Is Crypto Mining?

The digital gold rush is reaching another fever pitch, with Bitcoin and Ether attaining new record-breaking prices in 2021.

Most newcomers to the cryptocurrency industry have heard that new crypto coins are created by mining. The term might sound puzzling. What is crypto mining, and what kind of equipment does it require?

The Purpose of Mining

Before new transactions are added to a cryptocurrency’s public ledger (blockchain), they need to be verified. Miners are individuals who use their hardware to ensure that transactions made with a given cryptocurrency are correct. As a reward for maintaining the network, miners are given new coins. Therefore, cryptocurrency miners function as neutral auditors for transactions made on the network.

The primary purpose of cryptocurrency mining is to prevent double-spending. This was a unique problem that needed to be solved and prevented before digital currencies could become means of payment.

What Is Double Spending?

Double spending is a scenario in which the same digital coins are spent multiple times. By falsifying or copying digital funds, scammers could spend the same coin twice and create inflation by introducing an unlimited number of copied coins into the market. To ensure fairness without establishing a centralized authority, a network of miners takes on the role of the trusted third party in the system.

How Does Mining Solve Double Spending?

In simple terms, if the same bitcoin is spent in two transactions, the network of Bitcoin miners will validate the transaction with the most confirmations, while the other transaction will be rejected. Satoshi Nakamoto, the person or the group of people behind Bitcoin, solved this problem by implementing a consensus algorithm that ensures the validity of transactions.

A consensus algorithm is a term used for a process where a network of computers agrees on data validity, which in the case of cryptocurrencies is the validity of transactions. The most used consensus algorithms are “proof of work” and “proof of stake.”

Proof-of-Work Mining

Proof of work serves to ensure the fairness of the network. But how do you mine Bitcoin using this algorithm? Two conditions need to be met. The first one is that transactions getting added to the blockchain are first verified. That’s the easy part of a miner’s work. The second requirement is that a miner finds the correct or the closest number to a 64-digit hexadecimal value referred to as a “hash.” Nowadays, quickly finding this Bitcoin hash value requires a lot of computing power.

ASIC Miners

What is the crypto mining hardware requirement for a network such as Bitcoin? In 2009, when Bitcoin was first launched, people could mine it using regular desktop and laptop computers. However, employing just a central processor unit for mining has quickly turned out to be less profitable than using graphics processing units. Therefore, in 2010, the mining hardware for Bitcoin consisted mostly of graphics cards.

The third generation of Bitcoin mining hardware is the current one, and those are application-specific integrated circuit or ASIC miners – highly specialized hardware that’s only efficient at handling a specific type of task. In this case, the task is processing hash values and specific encryption methods faster than regular computer hardware.

Anyone researching how to mine Bitcoin in 2021 will find that they would have to invest thousands of dollars to buy an ASIC miner and pay the electricity bills.

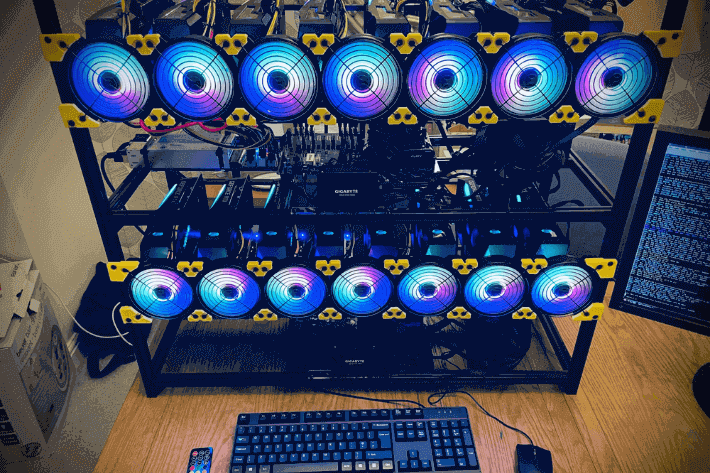

GPU Mining

The cryptocurrency community usually looks at ASIC mining as a higher barrier to entry since the high price of these mining rigs limits the number of people who can participate in the network. That’s why there are some crypto projects that use PoW consensus mechanisms incompatible with ASIC. In addition, some projects aim to remain compatible only with widely available hardware, in contrast to pricy ASIC miners.

These hardware configurations are similar to everyday desktop computers, with a few notable differences. These mining rigs use multiple GPUs connected to the same motherboard to mine cryptocurrency. They’re also set up on open frames for easier cooling.

ASIC vs. GPU Mining Efficiency

Hardware power or hashing performance is expressed in hashes per second (h/s). Since the number of operations modern hardware can process in a second is measured in millions and billions, it’s often expressed as Mh/s, Gh/s, or Th/s.

For example, Bitmain Antminer S19 Pro can process 110 Th/s for the SHA-256 algorithm on average. On the other hand, the latest GPU from Nvidia, 3090 RTX, can process about 128 Mh/s for the Ethash algorithm.

Proof-of-Stake Mining

If you were looking at which cryptocurrency to mine, most likely you’ve heard about proof of stake. This consensus algorithm revolves around staking assets rather than investing in hardware. Therefore, the miners receive compensation depending on the funds they’ve set aside as collateral while verifying other participants in the network.

For example, the Ethereum project plans to switch from the traditional PoW to the PoS system. The main incentives for making such a shift are greater security, lower environmental impact and barrier to entry, greater decentralization, and groundwork for future upgrades.

Upgrades to the Ethereum network could help ETH gambling venues have even faster deposit and withdrawal times.

Mining Pools

Mining crypto is easier and more efficient when miners join their hashing power and form pools. This is because mining pools increase the probability that one of their members will discover the solution for the target hash. After someone finds the solution, the reward is distributed across the pool in such a way that each miner gets a portion directly proportional to their mining power.

By joining large mining pools, individuals with low hashing power can still participate in the mining process and receive a reward for their work. Another benefit consists in lowering the risks of solo mining and reducing the impact of sheer luck. After all, betting with Bitcoin online is much more fun than betting on your hardware to find the solution for the next block.

What Is Crypto Mining’s ROI?

Return on investment or ROI is the most significant factor to consider before getting into crypto mining. Your profits will largely depend on the price of electricity, hardware, and mining difficulty, and these vary greatly.

ASIC miners can potentially return their value in Bitcoin after 14 to 18 months. By using renewable or cheap energy sources, you can further shorten this period.

GPU miners are in a better spot in terms of ROI than ASIC miners. However, with the COVID-19 pandemic and the ensuing global chip shortage, hardware prices have skyrocketed, and graphics cards are scarce.

Knowing how cryptomining functions is beneficial, even if you decide to invest directly in cryptocurrencies rather than hardware. It can also help you understand how crypto transactions work before you make a deposit on a BTC gambling website.

FAQ

How long does it take to mine 1 Bitcoin?

Mining 1 BTC with just one of the most efficient ASIC miners could take up to four years if the mining difficulty remains unchanged.

Is crypto mining dangerous?

Crypto mining isn’t dangerous. However, it’s a resource-intensive process that requires a significant monetary investment.

What is crypto mining, and how does it work?

Crypto mining is the process of verifying transactions made with BTC, ETH, BCH, and other cryptos. Miners receive newly minted coins as a reward for the invested processing power, time, and electricity. Cryptocurrencies are mined with GPUs or specialized hardware called ASICs.